SAN ANGELO, Texas — The Concho Valley Community Action Agency is providing citizens income tax preparation and e-filing services at no charge through April 15 at the Adult Literacy Council of the Concho Valley, 59 E. 6th Street.

Volunteers are available from 8 a.m. to 5 p.m. Monday thru Friday, however, appointments are required. Occasionally appointments may be available on the same day.

The service has been provided at the ALCCV for approximately 15 years when AARP provided the service, according to Marilynn Golightly, ALCCV director.

Volunteers are sponsored by the CVCAA sponsors and usually return the following year. Volunteers don't discuss individual taxes and there is no gossip, according to Golightly.

The ALCCV provides people with the option of placing all the necessary documentation in an envelope and leaving it at the center. Once the taxes have been filed or if the preparer has any questions, they will contact the individual.

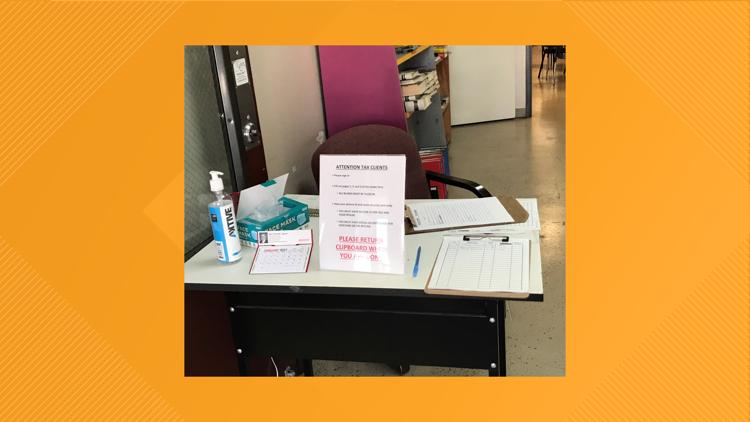

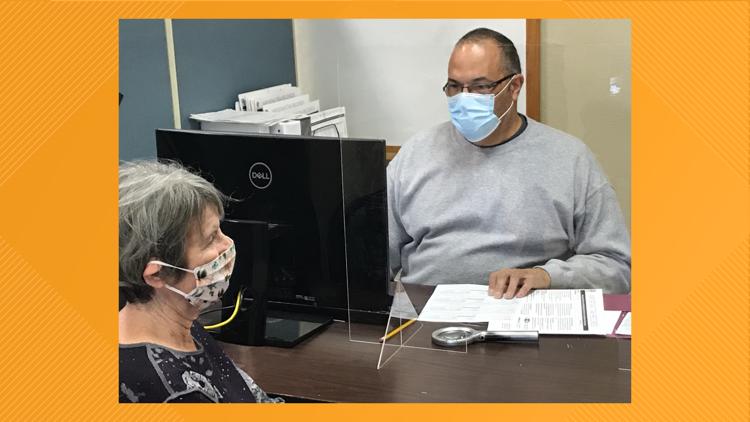

To prevent the spread of COVID-19 the ALCCV is not allowing people to wait in line to be seen and is only allowing one person to come in at a time. The center is also practicing social distancing and wearing masks.

Tax preparers, such as Tony Bonilla have been volunteering for approximately 30 years.

Bonilla began in 1991 when he was stationed at Goodfellow Air Force Base through the Volunteer Income Tax Assistance or Vita program. The VITA program assists with tax preparation and e-filing.

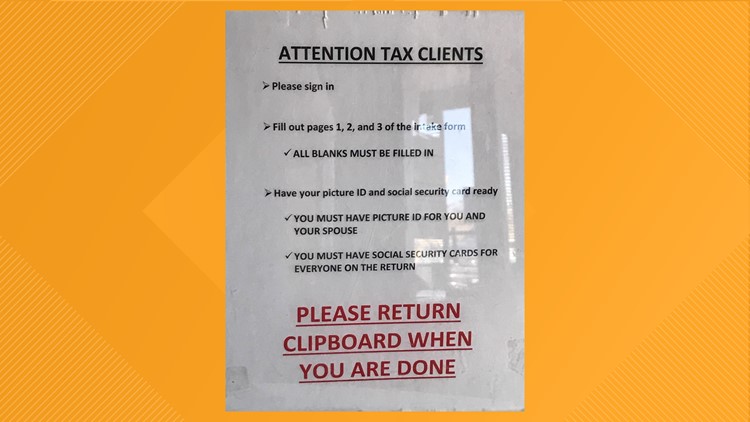

To accurately file a tax return, the file will need to present specific documentation.

“We need to see photo ID, social security cards for everyone you are claiming on the return, birth certificates if you have them; all W-2’s if you work or 1099 for any interest, dividends or if you have a miscellaneous job, unemployment compensation forms,” Bonilla said.

Correct direct deposit information should be provided if the filer wants the return deposited into a bank account.

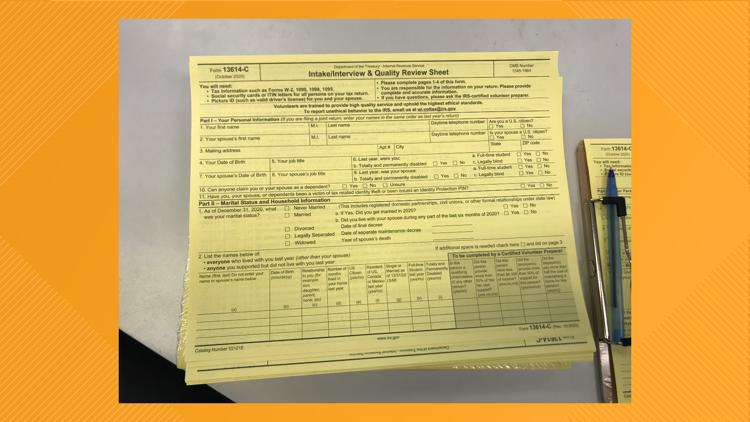

Each person will be asked to fill out an intake form upon arrival or they can have it filled out when they arrive at the appointment. Form 13614-C can be downloaded from the IRS website.

The filer will be asked whether or not they received a stimulus check or checks.

“Yes, we will ask you if you received it,” Bonilla said. “That’s all we are asking for; it does not affect the taxes.”

The CVCAA does not have a dollar limitation but the system does, according to Bonilla.

“We do basic returns, that is the nature of the program,” Bonilla said. “For those individuals who have the business on the side cutting grass or daycare those would probably have to be referred to paid preparers.”

A tax preparing session takes approximately 30 minutes to allow for social distancing.

“After we prepare the return and file it, which right now is delayed until the 12th of February, it goes into the IRS system; it normally takes two weeks,” Bonilla said. “There is potentially a delay for those individuals who receive earned income credit, that delays it for up to 5 days.”

Citizens should call the Concho Valley Community Agency at 325-653-2411 to schedule an appointment. Citizens are asked to have all documentation on hand and be on time.

For additional information about programs at the Adult Literacy Council of the Concho Valley or to volunteer call 325-657-0013.